On Aug. 28, the U.S. Department of Commerce, Bureau of Industry and Security (“BIS”), proposed new regulations revising certain aspects of the exclusion process for Section 232 steel and aluminum tariffs. BIS also requested additional public comments on its proposals.

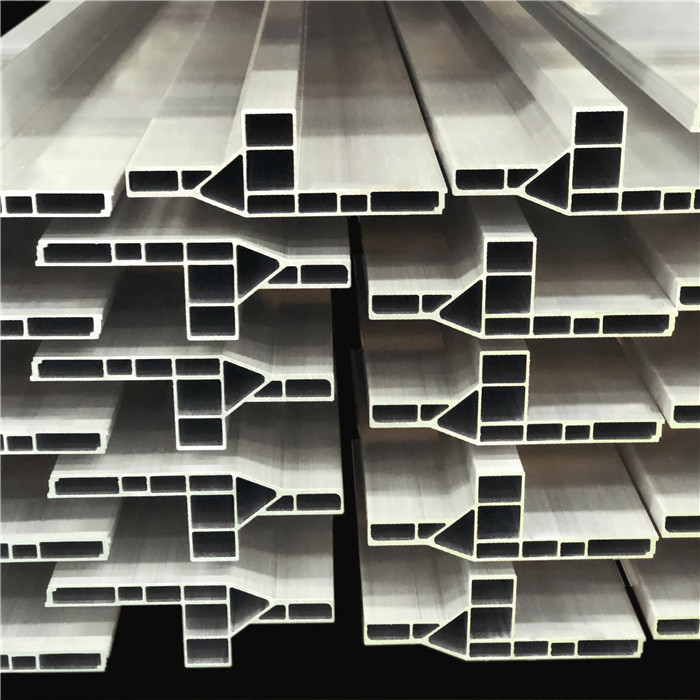

Originally enacted by Presidential Proclamations in March 2018, the Section 232 tariffs impose duties on certain imports of aluminum and steel into the United States. The Presidential Proclamations also allowed for specific aluminum and steel imports to be excluded from the Section 232 duties upon an approved exclusion request. For example, exclusions could be granted to steel or aluminum imports if the product was not “produced in the United States in a sufficient and reasonably available amount or of a satisfactory quality.” Exclusions could also be granted on the basis of “specific national security considerations.” The Presidential Proclamations vested the Secretary of Commerce with the authority to issue procedures for exclusion requests. The resulting procedures are collectively known as the exclusion process. Aluminium Profile 3030

Prior Changes to the Exclusion Process

Since March 2018, BIS has published five interim final rules (“IFRs”) that revised the Section 232 exclusion process. These revisions include (1) establishing the exclusion process; (2) increasing the transparency, fairness, and efficiency of the exclusion process; (3) allowing the public to submit new exclusion requests through an online portal; (4) establishing the General Approved Exclusions (“GAEs”) to streamline the exclusion process; and (5) suspending 30 of the previously approved GAEs which no longer met certain criteria. The Aug. 28 BIS notice serves to finalize these IFRs.

In January 2022, a new Presidential Proclamation directed the Secretary of Commerce to seek public comment on the exclusion process. Based on those comments, BIS published on Aug. 28 four proposed changes to the Section 232 exclusion process. The BIS notice also welcomes additional comments on these proposals.

Four Newly Proposed Changes to the Exclusion Process

First, BIS proposed changes to the criteria for GAEs. In general, the GAE process allows steel and aluminum products classified under a specific Harmonized Tariff Schedule of the United States (“HTSUS”) subheading to be excluded from the Section 232 tariffs. Under the proposed changes, GAEs would be granted to HTSUS classification codes (or subproducts) with very low rates of successful objections. Previously, GAEs were granted to HTSUS statistical reporting numbers that received no objections rather than granting or denying the exclusion after reviewing the substance of the objections. The BIS proposal would allow it to focus on meritorious objections and would decrease the incentive for parties to file objections lacking in merit. BIS reiterated its commitment to maintaining GAEs as a policy matter.

Second, BIS proposed the creation of a General Denied Exclusions (“GDEs”) process. In contrast to GAEs, GDEs would be implemented if the HTSUS classification code (or subproducts) have very high rates of successful, substantiated objections. BIS noted that public comments requested a GDE process. BIS anticipates that this proposed GDE process would increase efficiency and have little impact on which products are ultimately subject to or exempted from the Section 232 tariffs.

Third, BIS proposed new certification requirements for exclusion requests. The current language requires requesters to submit volume certifications that their business “expects to consume, sell, or otherwise use the total volume of product . . . within the next calendar year.” The proposed modifications would include an additional step before filing for an exclusion. Under the proposal, requesters would first need to certify that they made reasonable efforts to source their product from the United States and then, if unsuccessful, that they made reasonable efforts to source their product from a country with which the United States has arrived at a satisfactory means to address the threat to national security under Section 232. Eligible markets for sourcing include Argentina, Australia, Brazil, Canada, the European Union, Japan, Mexico, South Korea, and the United Kingdom.

In addition to a statement of certification, requesters would also need to provide evidence of their sourcing attempts within the 12 months preceding the date of submission of the exclusion request. Failure to provide such evidence would result in the rejection of the exclusion request.

Fourth, BIS proposed new certification requirements on objection forms. Objectors would need to satisfy similar certification requirements detailed in the third proposal. This would ensure that objectors can supply a comparable quality and quantity of steel or aluminum and make it “immediately available” to requestors in line with the standards described in the previous paragraph. In addition to the certification, objectors would be required to file evidence that they have commercially sold the same product as that which is being requested within the last 12 months, or evidence that they have engaged in sales discussions with the requesting company or another company requesting the same product within the last 12 months.

BIS is seeking additional public comment on these proposed changes. Comments are due to BIS on Oct. 12 through the Federal eRulemaking website. Specifically, BIS is requesting additional public comments on proposed changes, including, but not limited to:

Please contact us for the full list of topics requested for public comment, proposed certification language, or related questions.

If you have any questions regarding the content of this alert, please contact Mark Ludwikowski (mludwikowski@clarkhill.com; 202-640-6680), Kevin Williams (kwilliams@clarkhill.com; 312-985-5907), Will Sjoberg (wsjoberg@clarkhill.com; 202-772-0924), Aristeo Lopez (alopez@clarkhill.com; 202-552-2366), Kelsey Christensen (kchristensen@clarkhill.com; 202-640-6670), or Sally Alghazali (salghazali@clarkhill.com; 202-572-8676) of Clark Hill’s International Trade Business Unit, or Anthony Campau (acampau@clarkhill.com; 202-572-8664) of Clark Hill Public Strategies and Clark Hill’s Government Contracts and Regulation Business Unit.

This publication is intended for general informational purposes only and does not constitute legal advice or a solicitation to provide legal services. The information in this publication is not intended to create, and receipt of it does not constitute, a lawyer-client relationship. Readers should not act upon this information without seeking professional legal counsel. The views and opinions expressed herein represent those of the individual author only and are not necessarily the views of Clark Hill PLC. Although we attempt to ensure that postings on our website are complete, accurate, and up to date, we assume no responsibility for their completeness, accuracy, or timeliness.

Cyber, Privacy, and Technology Report

6060 T6 Mechanical Properties The Clark Hill approach is equally pragmatic and growth-minded, which is why we understand our clients’ toughest business challenges. Our multidisciplinary, global team of advisors focuses on smart legal solutions, delivered simply.